In situations where family members and estates span multiple countries and tax jurisdictions, the differences between each country’s laws can lead to complicated inheritance/estate tax issues.

International Inheritance / Estate Tax and Gift Tax Consulting

Japan’s inheritance and gift tax regulations mean that taxpayers often fall within their scope without being aware of their position. These taxpayers are those with a domicile in Japan and can include expats, senior executives, entrepreneurs and those in international marriages. In addition foreign nationals with no domicile in Japan who have diversified into stocks of Japanese companies or real estate here also face a possible liability.

Points to be aware of

The government revised the already complicated inheritance and gift tax laws with effect from 1 April 2017, with the aim of reducing the burden on short-term residents whilst at the same time making it more difficult for high net worth Japanese nationals to avoid the tax by emigrating.

Previously, all residents of Japan were treated equally for inheritance and gift tax purposes regardless of nationality. The new rules contain exemptions based on visa status and nationality, to ease the worries of Japanese businesses who found the country’s inheritance tax laws were proving an obstacle to recruiting highly-skilled professionals from overseas.

The new rules increase the complexity of inheritance and gift tax and so residents, both those on temporary assignment and in international marriages, need to be aware of the potential liabilities they or their heirs may face.

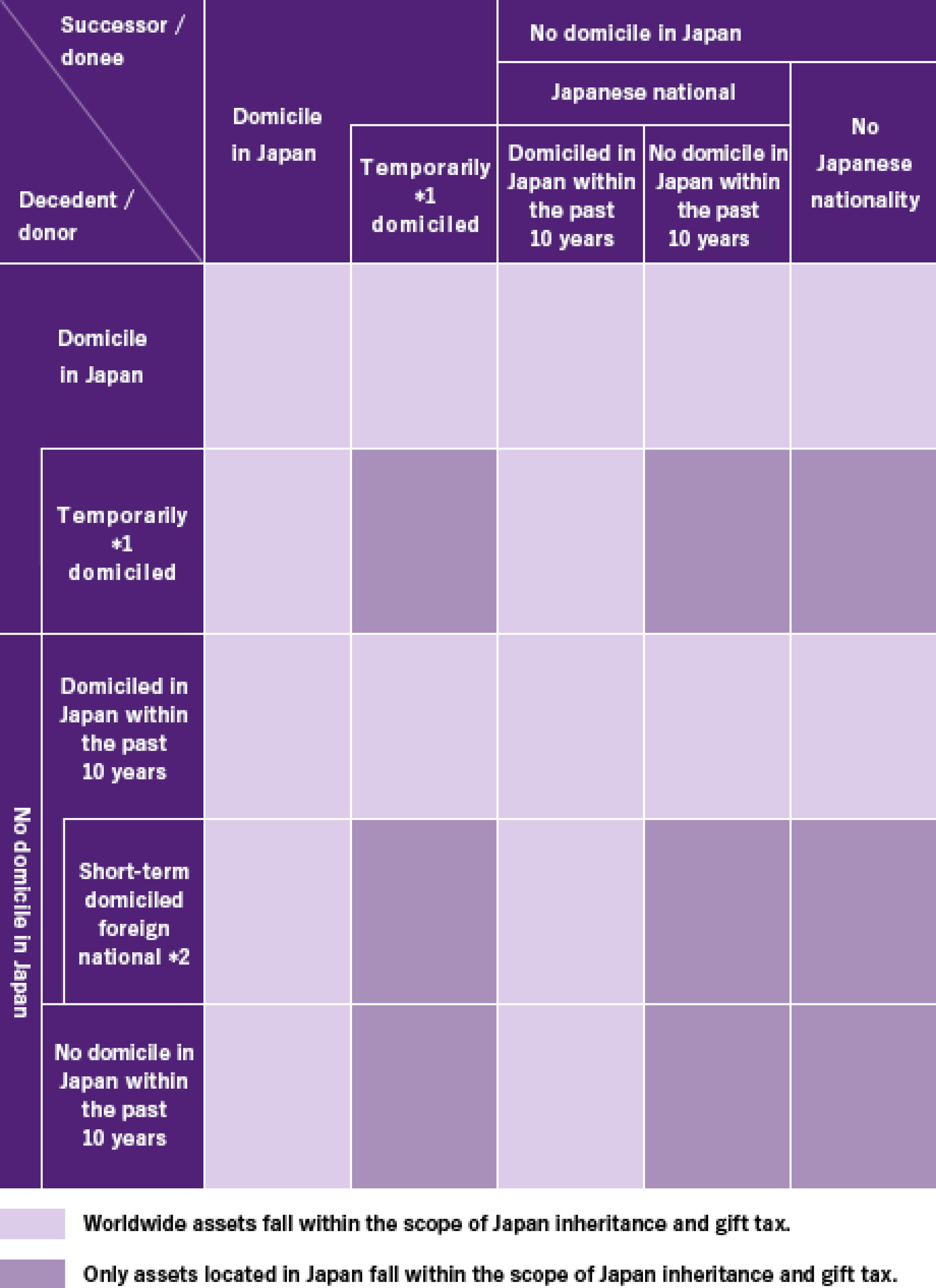

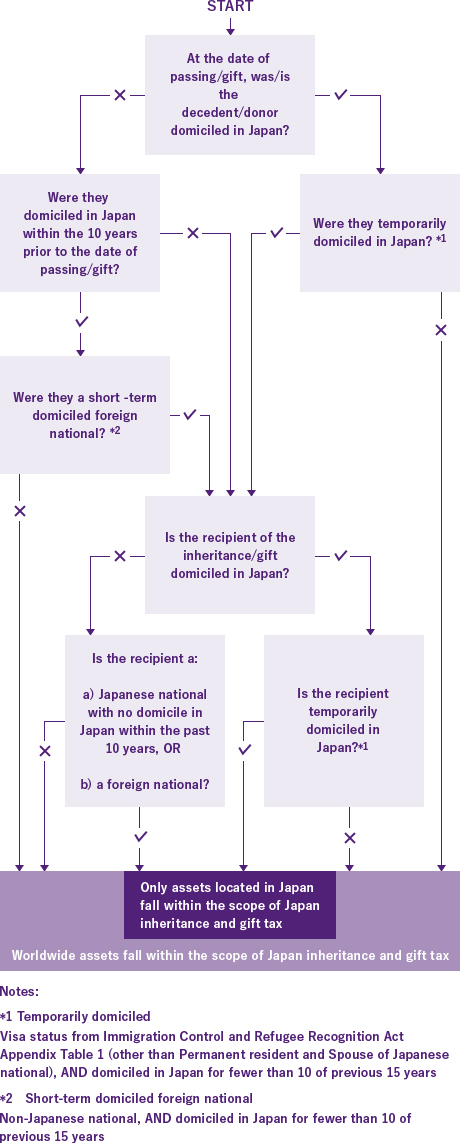

A taxpayer’s liability to Japanese inheritance tax and gift tax is summarised by the chart below together with a flowchart indicating how the new rules apply to taxpayers.

As a result of these rules, inheritance/estate tax can often be due on the same asset in both Japan and the country in which it is located. In cases where tax is due in Japan and another country, a credit can be applied for to take into account inheritance/estate tax paid in the other country. This can lead to complicated and burdensome filing requirements at a time when they are least needed.

Audits

The National Tax Agency has recently taken a much more aggressive stance towards inheritance tax audits involving cross-border inheritances. As a result of an increasing number of Tax Information Exchange Agreements that have been entered into with foreign countries, it has started contacting foreign government bodies to gain a clearer understanding of assets held overseas.

How can we help?

Here at Grant Thornton Taiyo Tax Corporation we provide inheritance/estate tax compliance services in conjunction with professionals from Grant Thornton International member firms in over 130 countries.

We can provide:

Compliance services to ensure that your inheritance/estate tax filing obligations are handled smoothly and with the least amount of worry for you.

Valuation services relating to shares in privately-held companies and real estate.

Advisory service for lifetime inheritance and gift tax planning